Repo Rate Cuts: Impact on Your Home Loan and Property Investment Plans

The Reserve Bank of India (RBI) plays a crucial role in the country’s economic stability, and one of its primary tools for regulating the economy is the Repo Rate. Recently, there have been discussions surrounding the cuts in the Repo Rate, and for many homeowners and property investors, it’s essential to understand what these changes mean for their current and future investments.

In this newsletter, we will break down the concept of Repo Rate Cuts and explain how these can impact your home loan and property investment strategies.

What is the Repo Rate?

The Repo Rate (short for “Repurchase Rate”) is the interest rate at which commercial banks borrow short-term funds from the Reserve Bank of India (RBI). This rate is a key tool used by the RBI to control inflation and stabilise the economy. When the RBI cuts the Repo Rate, it essentially makes borrowing cheaper for banks, which, in turn, can lead to lower interest rates for individuals and businesses.

How Do Repo Rate Cuts Affect Home Loans?

Home loans are often long-term commitments, and even small changes in interest rates can significantly impact the total repayment amount over time. Here’s how a Repo Rate cut directly affects home loan borrowers:

1. Lower EMIs (Equated Monthly Installments):

When the RBI reduces the Repo Rate, commercial banks generally pass on the benefit to home loan borrowers in the form of reduced interest rates. As a result, your EMI may decrease, making monthly repayments more affordable. This is particularly helpful for borrowers who are in the early stages of their loan repayment period.

Example: Suppose your home loan EMI is ₹40,000 with an interest rate of 8% p.a. A reduction in the Repo Rate may lower the interest rate to 7.5% p.a., bringing your EMI down to ₹38,000. This small reduction can lead to savings over the long term.

2. Lower Total Repayment Amount:

Along with a reduction in monthly EMIs, you could also see a decrease in the total amount you’ll repay over the entire loan tenure. With reduced interest rates, the overall cost of borrowing comes down, which means you could save a significant amount in the long run.

3. Increased Affordability for First-Time Homebuyers:

For potential homebuyers, especially first-time buyers, Repo Rate cuts can make home loans more affordable. With lower interest rates, EMIs become more manageable, making it easier for buyers to enter the real estate market.

Impact on Property Investment Plans:

Repo Rate cuts not only benefit home loan borrowers but also have significant implications for property investors. Let’s explore how investors can benefit from this monetary policy change.

1. Cheaper Financing for Property Purchases:

For property investors planning to purchase real estate using home loans, a reduction in the Repo Rate directly lowers the cost of borrowing. Cheaper financing makes investing in properties more attractive, leading to potential capital gains over time. Whether you’re investing in residential, commercial, or even land properties, financing becomes more accessible.

2. Impact on Property Prices:

Lower interest rates often lead to increased demand for properties as more people can afford home loans. As a result, property prices may rise due to greater demand, benefiting investors who are looking to sell their properties in the future. For those looking to buy, however, this can mean higher prices, especially in hot markets like Mumbai, Delhi NCR, or Bengaluru.

3. Favourable for Long-Term Investment :

Real estate is generally a long-term investment. Lower interest rates can make it more attractive for investors who are planning to hold properties for several years. In the long term, lower borrowing costs combined with increasing property values can lead to substantial returns on investment.

4. Impact on Rental Yields:

While property prices may rise, rental yields might also improve as more people seek rental properties due to their increasing affordability. This is especially true for metro cities where demand for rental properties tends to remain strong. For investors focused on rental income, a Repo Rate cut can provide an opportunity to earn better returns.

Conclusion:

A Repo Rate cut is a powerful tool used by the RBI to stimulate economic growth and manage inflation. For home loan borrowers, it translates into lower EMIs and reduced interest payments, making homeownership more accessible and affordable. For property investors, the cut enhances the attractiveness of real estate investments, offering better returns in the long run.

However, it’s important to remember that the overall benefits depend on the specific terms of your loan, the type of property you are investing in, and the broader economic landscape. If you are planning to buy a home or invest in real estate, now might be a good time to consult with financial advisors and real estate experts to make the most of these favourable conditions.

Stay informed and plan your property and finance strategy wisely.

Home Decor

The Comeback of Vintage: Mixing Old Souls with New Vibes

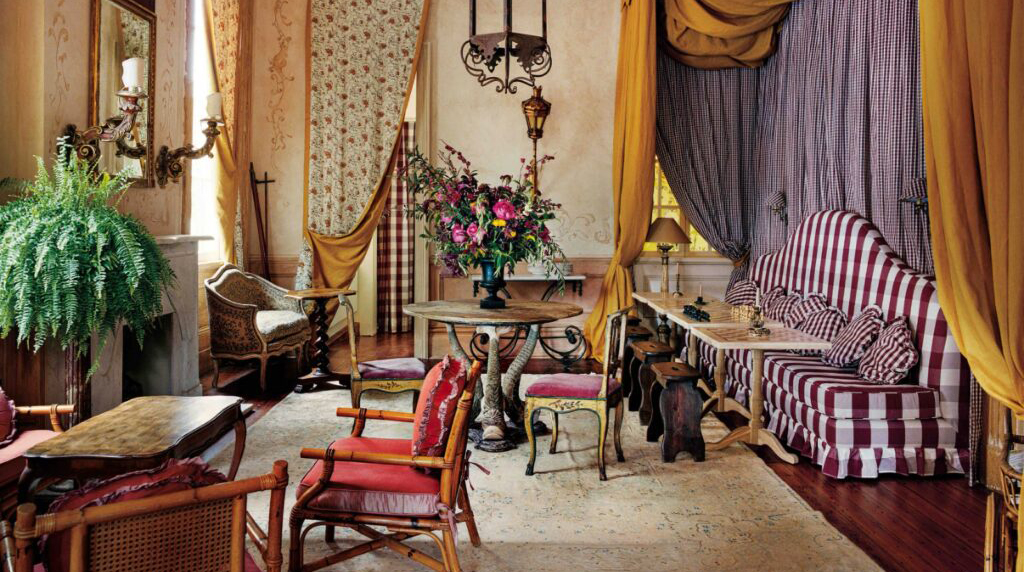

In a world where minimalism, Scandinavian chic, and modern luxury have long dominated the interior design scene, the nostalgia for the past is making a grand return. Today, vintage is more than just a trend, it’s an aesthetic renaissance. From the classic elegance of mid-century modern to the charming rustic appeal of antique pieces, we are witnessing a revival of time-honoured styles infused with fresh, contemporary vibes.

Why Vintage Is Making a Comeback

India, with its rich cultural tapestry, has always embraced elements of history and tradition in its living spaces. In recent years, however, the notion of vintage has expanded beyond old-world charms to incorporate a wider range of design influences. This is not merely a return to the past, but a new interpretation of vintage elements, where timeworn treasures find themselves in harmony with sleek modernity.

Several factors explain this resurgence:

Incorporating Vintage into Modern Homes

So, how can you weave the best of both worlds, vintage charm and modern aesthetics, into your home? It’s all about balance. Here are some creative ways to merge old souls with new vibes in your living spaces:

1. Antique Furniture Meets Modern Minimalism

The key to this fusion is balance. Consider an antique wooden wardrobe paired with a minimalist, neutral-colored modern sofa. Or place a vintage brass chandelier above a sleek, contemporary dining table. The richness of the old blends effortlessly with the streamlined simplicity of the new design.

For instance, a traditional Indian carved wooden chest can be used as a statement coffee table, while the surrounding seating area can feature contemporary, low-profile sofas in muted tones. This balance creates a harmonious juxtaposition, adding depth and character to the room.

2. The Power of Colour

While vintage pieces are often rich in earth tones, mixing them with bold, vibrant hues is a game-changer. A statement vintage armchair, reupholstered in a bright modern fabric like mustard yellow or teal, can infuse new life into the piece. Similarly, pair old-fashioned, wooden photo frames with a background of contemporary wallpapers or abstract art for a striking contrast.

Vintage does not have to mean dull; infuse it with contemporary colours to breathe new energy into traditional designs.

3. Art and Accessories

One of the easiest ways to blend vintage into a modern setting is through the use of art and accessories. Think antique mirrors, vintage paintings, or traditional pottery that sit perfectly beside contemporary sculptures or abstract paintings. Accessories such as brass or copper trays, terracotta vases, or wooden sculptures can easily elevate modern spaces while retaining their old-world charm.

By carefully selecting and placing accessories, you can create an eclectic, layered feel without overwhelming the space.

Popular Vintage Styles in Indian Homes

India’s vast cultural history offers a plethora of vintage design influences, many of which are finding new relevance in contemporary décor. Here are some classic vintage styles with a fresh twist:

1. Colonial Revival

The British Colonial era has long been a source of inspiration for vintage décor in India. The quintessential blend of rustic wooden furniture, leather accents, and old maps makes for an inviting yet elegant home. Today’s version, however, combines antique colonial pieces with light, modern furnishings and minimalistic décor elements to create a balanced, sophisticated look

2. Rajasthani Royalty

Old Rajasthani furniture, adorned with intricate carvings and bold, rich colours, can now be seen in a modern context. Instead of overwhelming the space with too many bold elements, one or two key pieces, like an ornately carved jharokha mirror or a wooden chest, can stand out as focal points in a more neutral or industrial interior.

3. Mid-Century Modern Indian Style

The post-independence era in India saw the rise of mid-century modern design. This style, featuring clean lines, functional forms, and organic shapes, is making a big comeback. Vintage teak furniture pieces, such as Kumhar hand-turned tables or safari chairs, can be paired with more contemporary finishes for a seamless mix of old and new.

4. Art Deco Glamour

The Art Deco movement, which first flourished in India during the early 20th century, can now be seen revived in contemporary homes. Elements such as geometric patterns, bold contrasts, mirrored furniture, and metallic finishes help bring this glamorous era into modern homes.

Conclusion

The resurgence of vintage in home décor is more than a trend; it fuses history, culture, and modernity. Mixing old and new, Indian homeowners can create stylish and meaningful spaces, each piece telling a story and supporting a sustainable lifestyle. Whether drawn to colonial furniture or Rajasthani craftsmanship, vintage and contemporary styles add a personal touch. By 2025, vintage will remain a powerful design choice that connects generations, tells stories, and makes homes feel timeless.